2015 Predictions

1. Rates will remain within a .25% close range in the next year – The Federal Reserve will closely monitor the economy and raise rates only when the indicators signal that the move would not adversely affect the housing market recovery. A weak economic recovery still looms and it has been said this is the weakest recovery after a recession since the Depression. People are not feeling the recovery and wages are lower. The domestic economy is still struggling to create meaningful lift off. Employment, GDP and foreign relations will all play significant roles in the continued economic recovery and future of interest rates.

2. Lending standards will loosen – First-time home buyers may be the biggest beneficiaries. Lenders have a handle on their risk and have adjusted guidelines accordingly. Fannie Mae has announced the comeback of 3% down payment programs, FHA just reduced monthly mortgage insurance, and special down payment assistance programs are affording buyers additional opportunities to buy homes.

3. Home prices will rise more slowly – The price appreciation over the past few years will allow more and more people to sell their homes next year, leading to more supply and easing inventory causing a more balanced market. The December 2013 10.8% year-over-year increase can be compared with September 2014 4.8% year-over-year change illustrating how much has changed with the past year.

4. Affordability will decline – Although price appreciation has slowed, this doesn’t mean that housing will be more affordable. Price appreciation may still outpace wages. Accordingly to Trulia, 2013 incomes rose just 1.8% in nominal terms. Realtor.com predicts 5%-10% decline in affordability. Rising rates can further erode affordability.

5. Millennials will overtake Gen Xers as home buyers. Millennials have been faced with some financial challenges not faced by previous generations due to the great recession. Approximately 42% of Millennials claim they want to buy a home in the next one to five years, compared to just 31% of Generation X. The Millennials are late bloomers to the housing scene and their lack of homeownership is not because they are not interested in owning, but this generation has been delaying getting married and having kids, which are two key drivers to buying a home. They have also faced mounding student debt and a challenging permanent job market.

6. Rent increases will outpace home value growth – Seattle ranked 5th nationally for annual rent growth in 2014. Strong job growth and an increasing population combined with limited housing supply will push rents higher. Rising rents combined with low interest rates and a more stable housing market will lure more renters into the housing market.

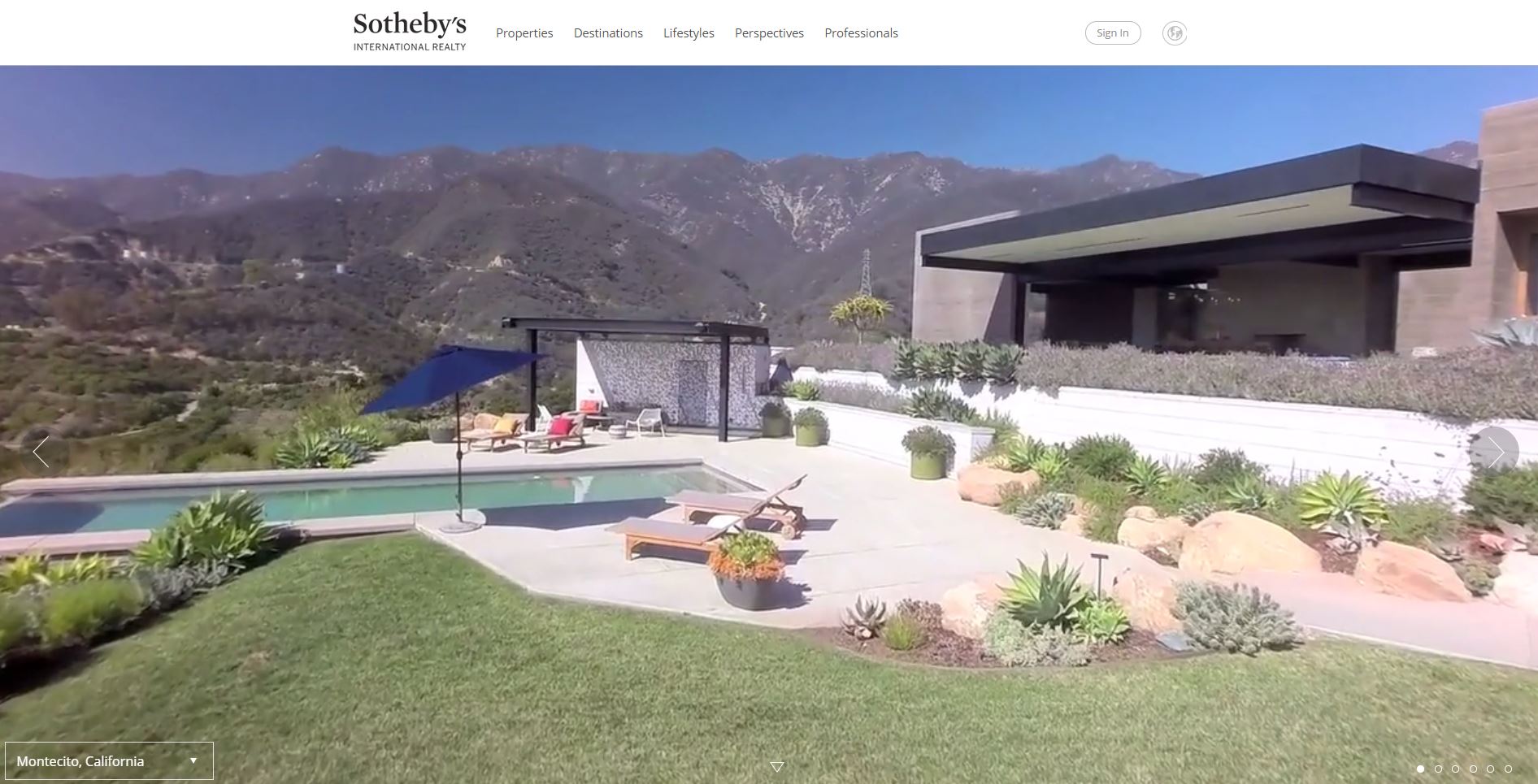

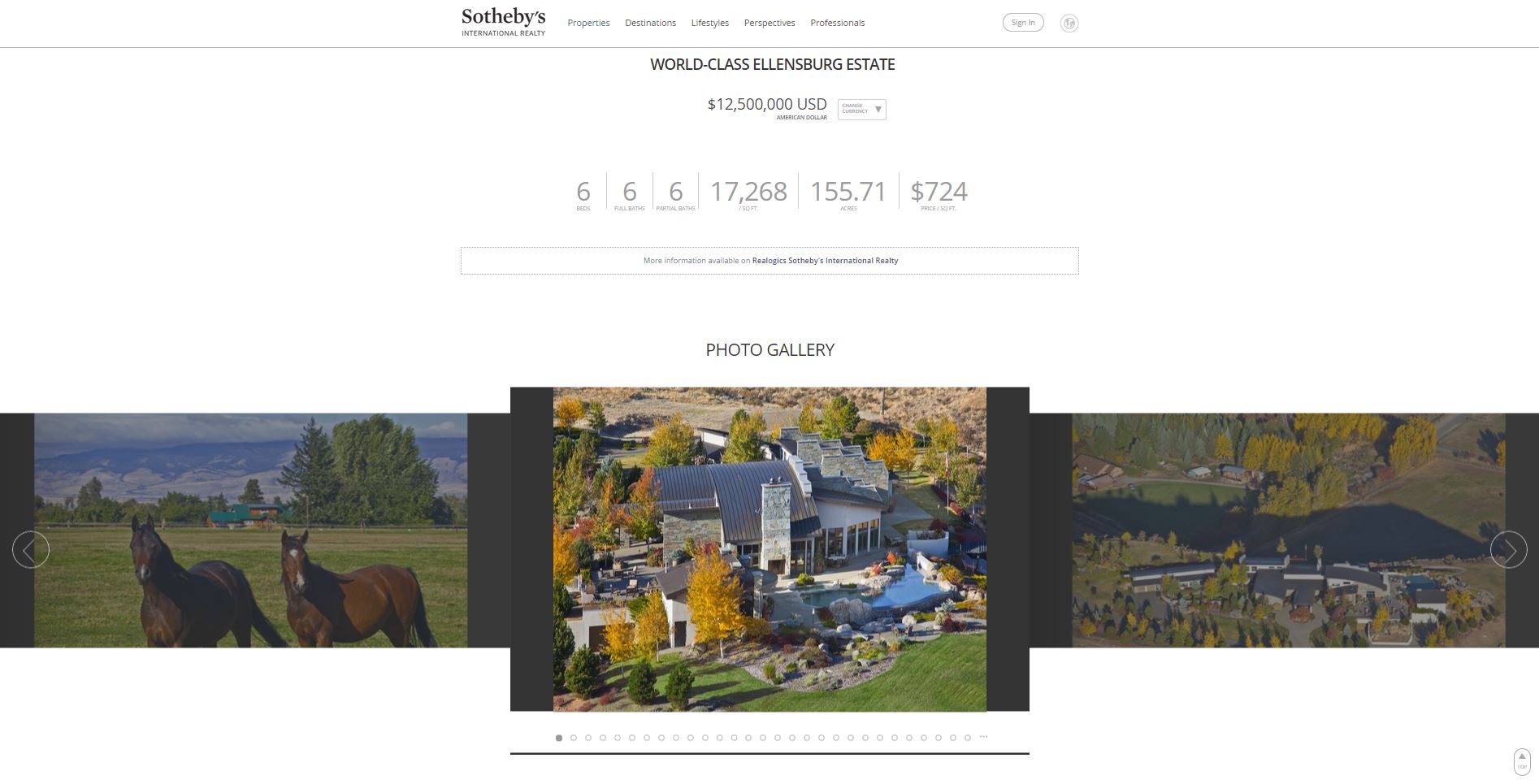

7. Second homes make a comeback – Vacation home sales surged 29.7% and accounted for 13% of all transactions in 2013 according to Realtor.com. A strengthened economy, affordable interest rates, and a stable real estate environment are all contributing factors to this rebound. Recent growth in the equity markets has increased wealth and confidence and given way for investors to purchase recreational properties.

8. Landlords reign – Rising rents make owing rental property an attractive investment. Multi-family will continue to thrive and drive investors into the market due to the opportunity. Consumers forming their own households will need to rent a home as they save up for down payment.

9. Foreclosures and short sales will fall – 2014 foreclosure filings were down 17.2% from the prior year and are expected to reach pre-recession levels. A stronger job market, price appreciation, and consumer confidence have contributed to the economic recovery and it is expected to continue in 2015.

10. Global citizenship and international real estate investment will soar – There is a growing trend of international buyers hedging their home currency and investing in United States real estate. The strength of the US Dollar, a thriving tech community, and recent extended VISA terms will continue to attract international buyers to purchase properties for vacation and investment. Many buyers are purchasing these properties sight unseen purely based on the economic opportunity.

Information obtained from Forbes, Realtor.com and The Seattle Times.